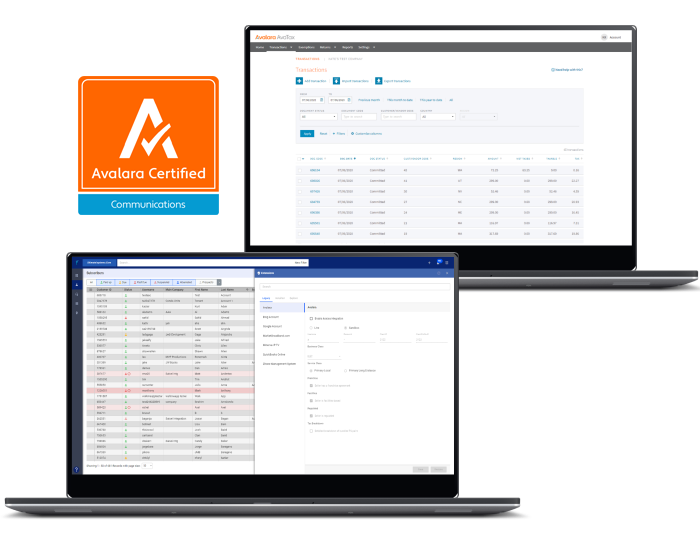

Control Tax Compliance

Eliminate ISP tax compliance stress with a solution that automates calculations, collections and reports. Avalara’s seamless integration with VISP simplifies the tax collection process and keeps your ISP compliant.

- Automatic tax rate calculation for all jurisdictions

- Real-time tax calculation for new sign-ups

- Subscriber tax exemption support

- Tax report automation

- In-app Integration

- Improve ISP tax compliance efficiency

- Reduce manual effort and errors

- Save time and resources

- Avoid fines and penalties

- Easy integration with VISP

Integrate VISP with  and automate your ISP’s tax compliance.

and automate your ISP’s tax compliance.

A prebuilt connection makes it easy to start.

High resiliency & scale for real-time or batch processing.

Complex tax logic supports geospatial jurisdictional calculations.

Supports a wide array of communications products and services.

Many Visp.net and  customers have already seen the benefits of integrating the two solutions.

customers have already seen the benefits of integrating the two solutions.

Setting up  +

+  integration is easy and straightforward. Follow these simple steps:

integration is easy and straightforward. Follow these simple steps:

- Contact Avalara to create an account.

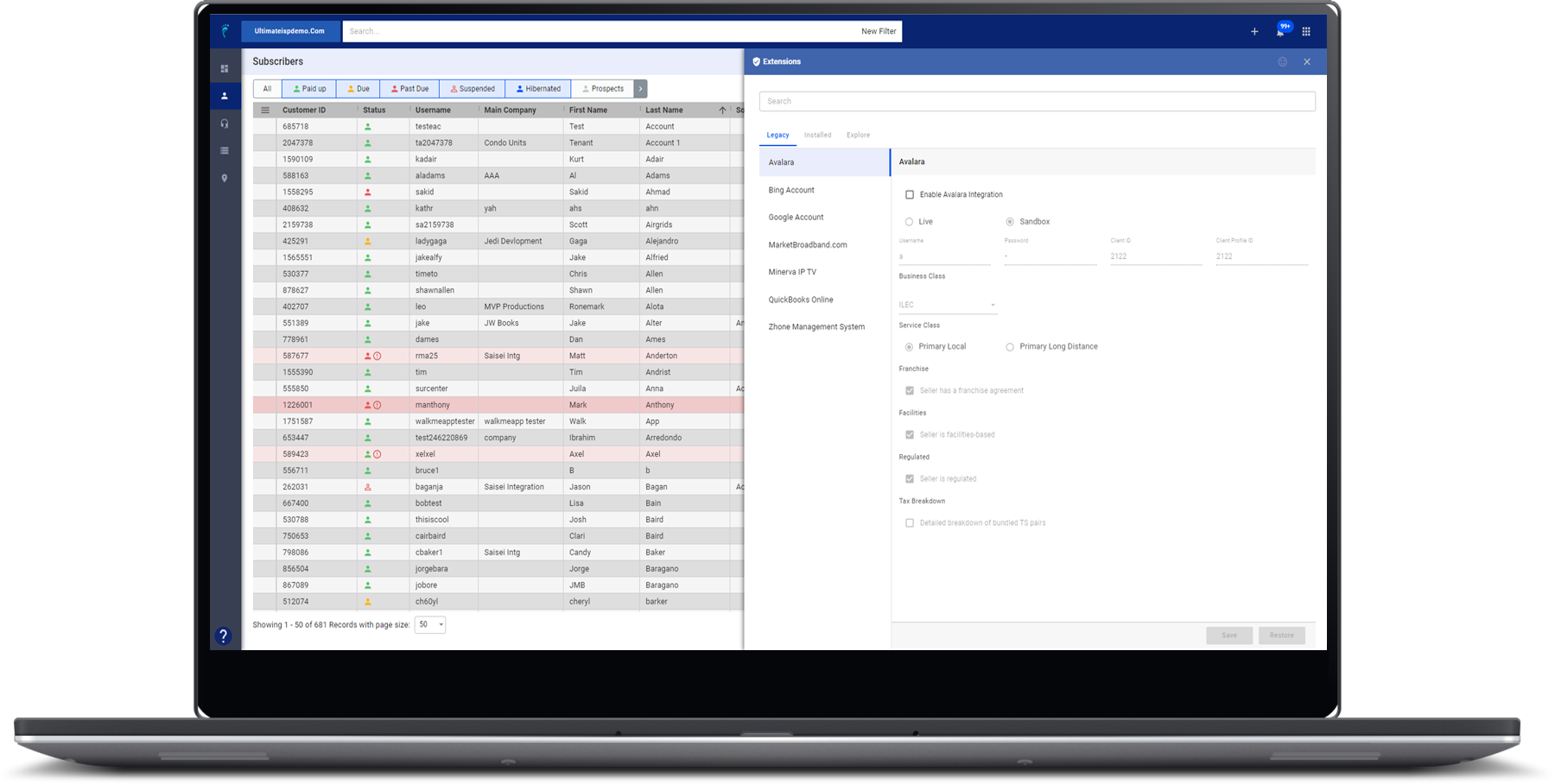

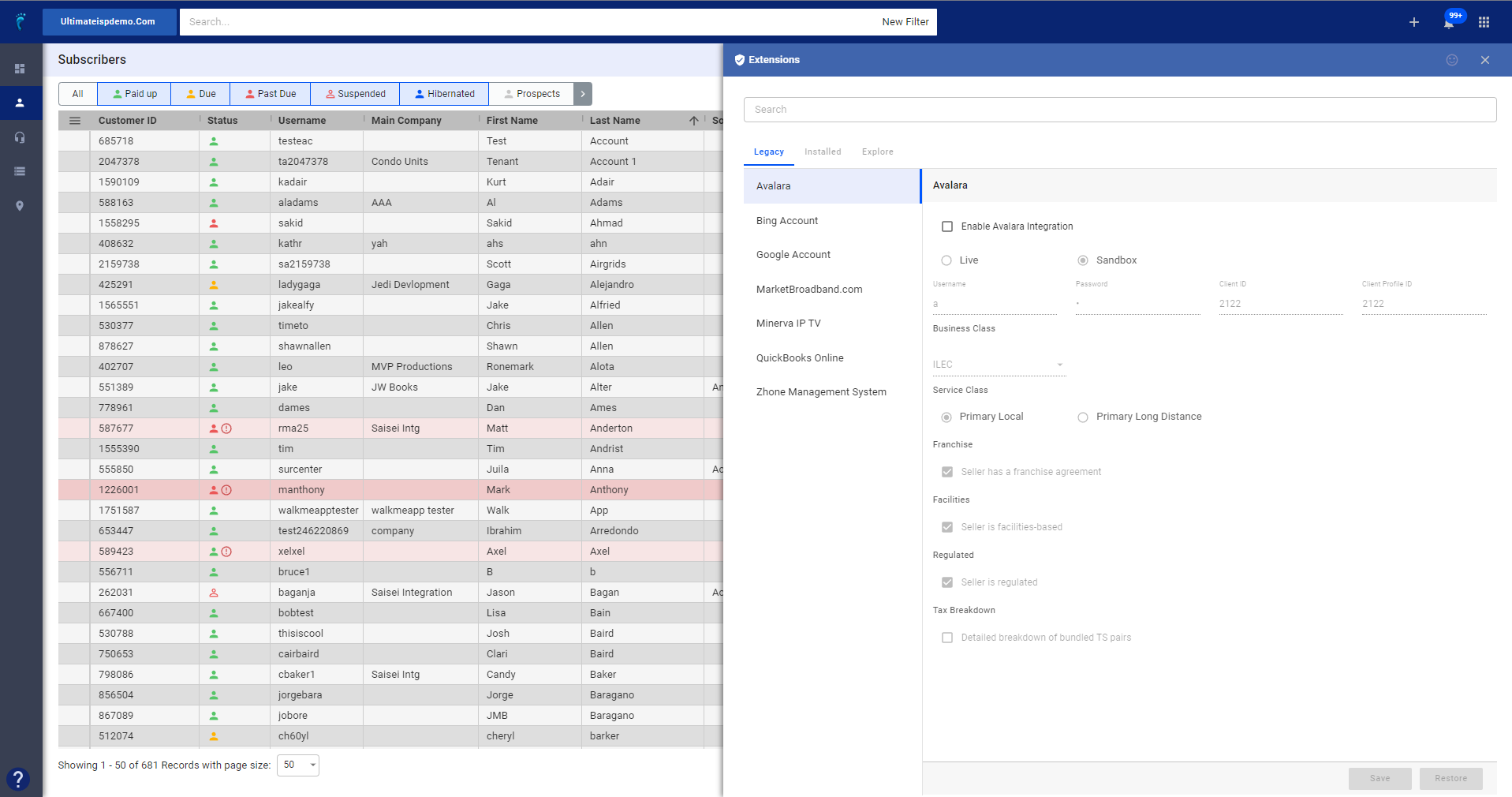

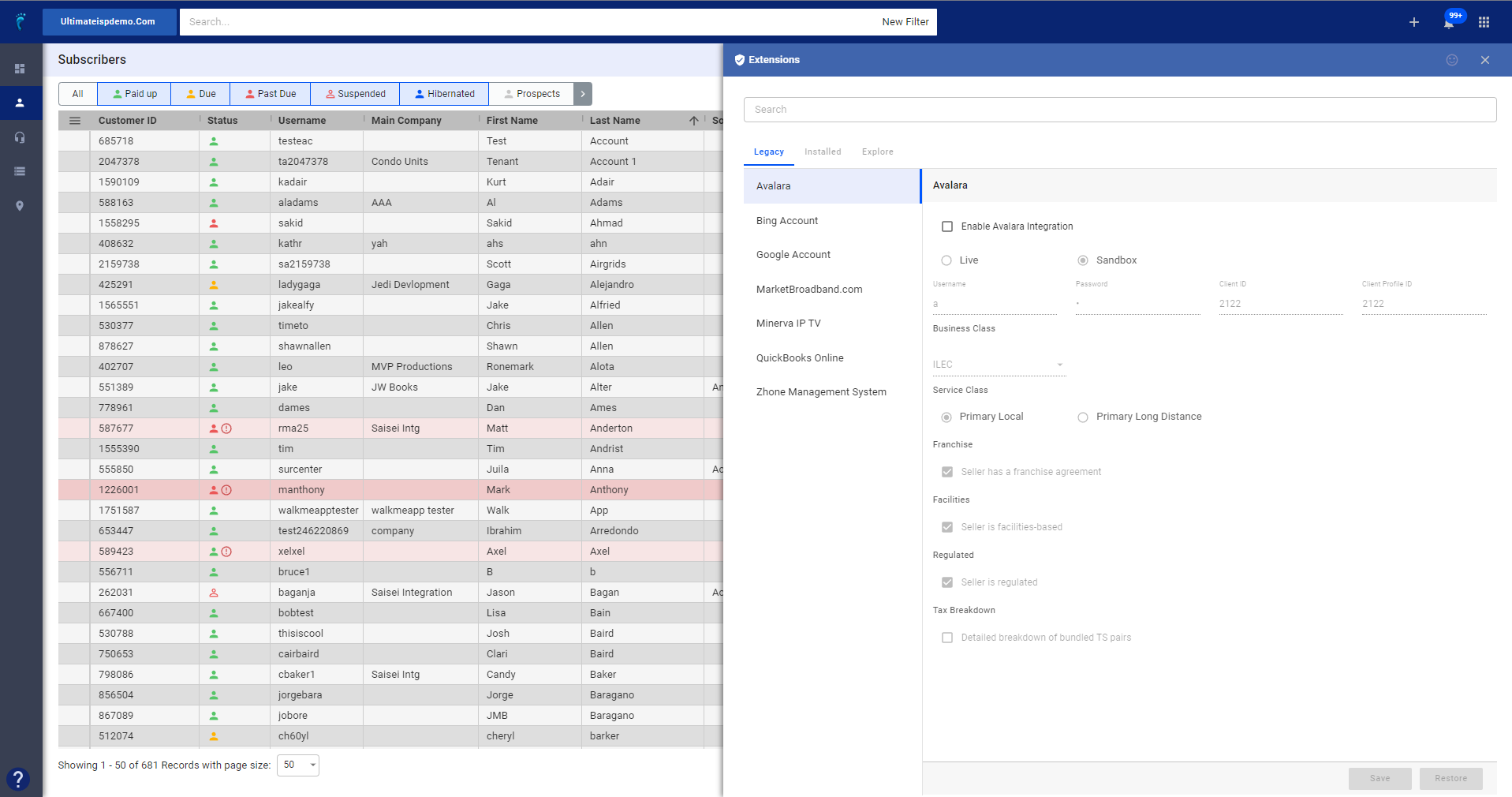

- Log in to your VISP account

- Go to the “General Settings” tab and click on “Extensions”

- Select “Avalara” as your tax engine

- Enter your account details

- Configure your tax settings as needed.

Integrating VISP with  can save you time, reduce manual effort and improve accuracy in tax compliance. Take advantage of this integration today and simplify your tax compliance process.

can save you time, reduce manual effort and improve accuracy in tax compliance. Take advantage of this integration today and simplify your tax compliance process.

How important is your success?

+

+