This guide outlines the process of adding a custom item to a customer invoice using the ‘Items Manager’ feature. This is particularly useful when you need to bill for one-time charges, recurring fees, or bundle specific charges with packages.

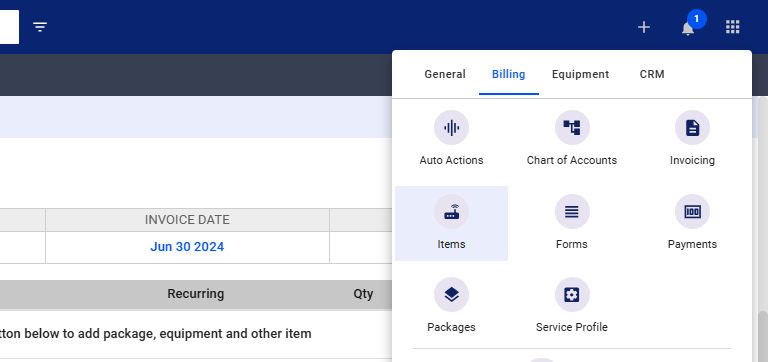

1. Accessing the Items Manager

-

- Click on the nine-dot menu in the upper right corner of the screen.

- Select the “Billing” tab.

- Choose “Items”.

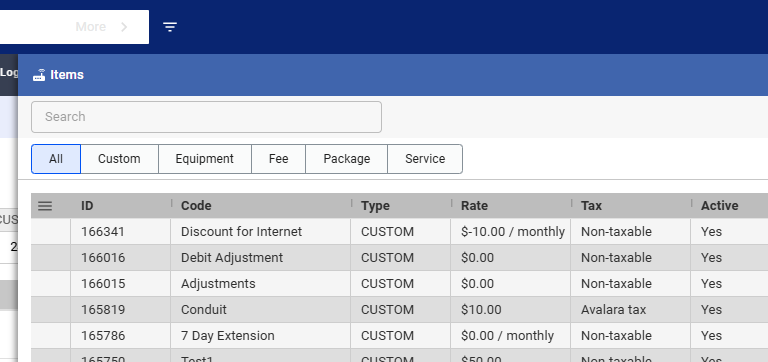

2. Understanding Item Types

Before creating an item, it’s important to understand the different types:

-

- Custom Item: This is the most versatile type and encompasses any charge or fee. It can be a one-time charge, a recurring fee, or bundled with packages.

- Fee: This refers to automated charges triggered by a specific event (e.g., hibernation fee, suspension fee, credit card fee).

- Equipment Charge: Use this for charges related to specific equipment or devices.

- Package: This allows for more configurable package settings, including bundling options.

- Service: This is for adding services to packages or invoices, but its use is limited at the moment.

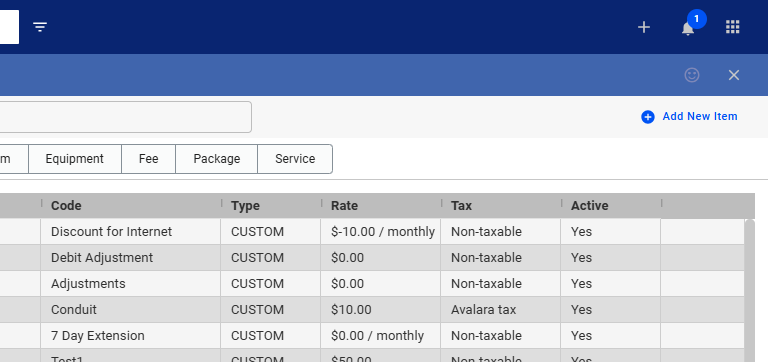

3. Creating a Custom Item

- In the Items Manager, click the “+ Add New Item” button.

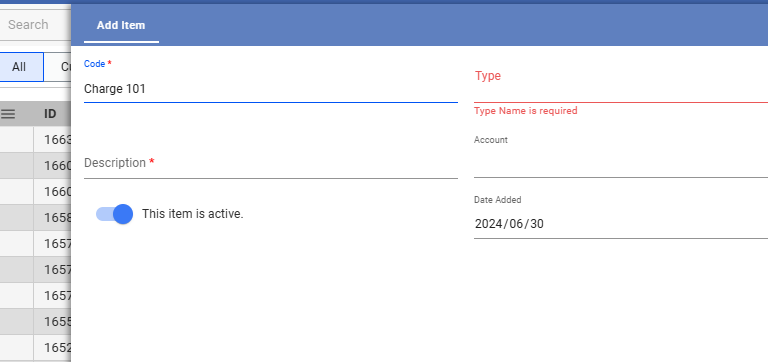

4. Setting Up Your Item

- Code: Enter a unique code for easy identification (e.g., “rental” for equipment rental).

- Type: Select “Custom”.

- Description: Provide a clear description (e.g., “Rental Charge or Fee”).

- Account: While optional initially, it’s recommended to set up a chart of accounts for better financial tracking. This allows you to categorize items as revenue, expense, etc.

- Status: Ensure the “Item is Active” toggle is enabled. The date will be set by default.

- Click “Add”.

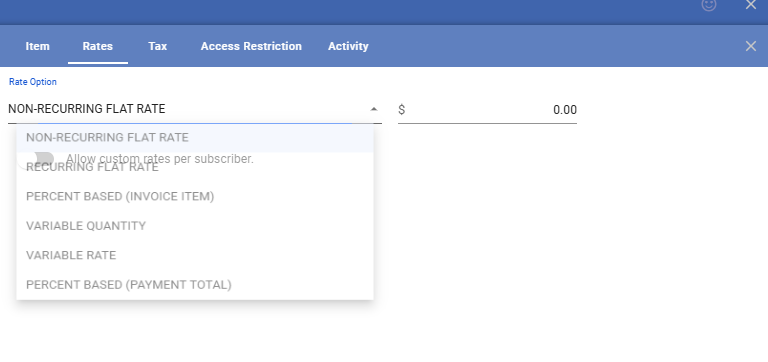

5. Setting the Rate

- Go to the “Rates” tab.

- Rate Option: Choose how the charge will be applied:

- Non-recurring

- Recurring flat rate

- Percent-based

- Set the rate amount (e.g., $10 for a flat rate).

- Enable “Allow custom rates per subscriber” if you might need to adjust the rate for specific customers in the future.

Click “Save”.

6. Configuring Tax Settings

- Go to the “Tax” tab.

- Select the appropriate tax setting:

- Non-taxable

- Use subscriber’s tax settings

- Avalara tax (requires integration with Avalara)

- Click “Save”.

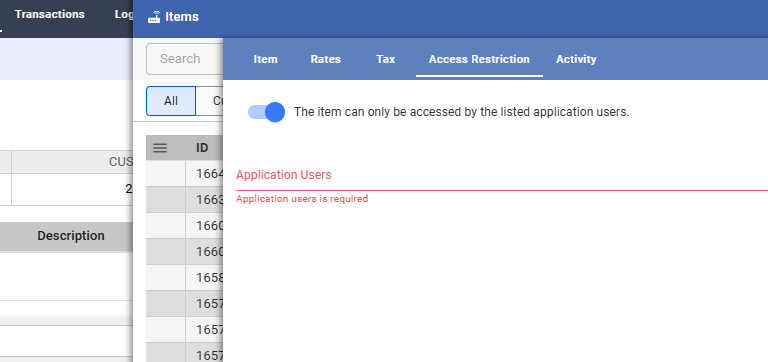

7. Managing Access Restrictions (Optional)

- Go to the “Access Restrictions” tab if you need to limit user access to this item.

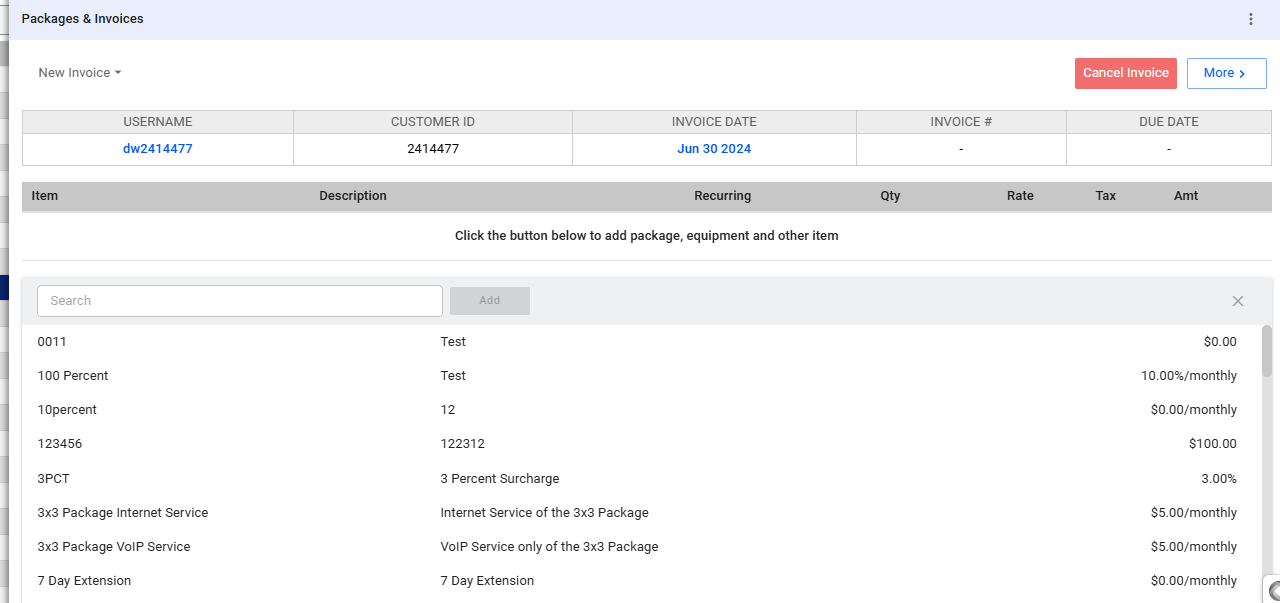

8. Adding the Item to an Invoice

- Close the Items Manager by clicking the “X” button.

- Return to the subscriber’s profile and the “New Invoice” section.

- Click the “+ Other Item” button.

- In the search field, type the code you created (e.g., “rental”).

- Select the item from the list and click the blue “Add” button.

- If the charge is recurring, check the “Recurring” box and configure the settings:

- Proration options

- Auto-suspend

- Expiry date

- Set the quantity and verify the tax and final amount.

- Adjust the invoice date if necessary.

- Click “Save”.

💡 For more information about this and all other features in Visp, reach out to your Visp Client Success Team today.

Phone: 541-955-6900Email: success@visp.net

Open a ticket via www.visp.net/ticket