This guide outlines the steps to set up credit card processing fees within your system. This allows you to charge a specific amount or percentage for each transaction.

Prerequisites:

- Merchant Account: You need an active merchant account with a provider that supports this functionality (e.g., IPpay, Authorize.net , Stripe).

- Access to Payment Settings: Ensure you have the necessary rights or permissions to modify billing and payment settings within your system.

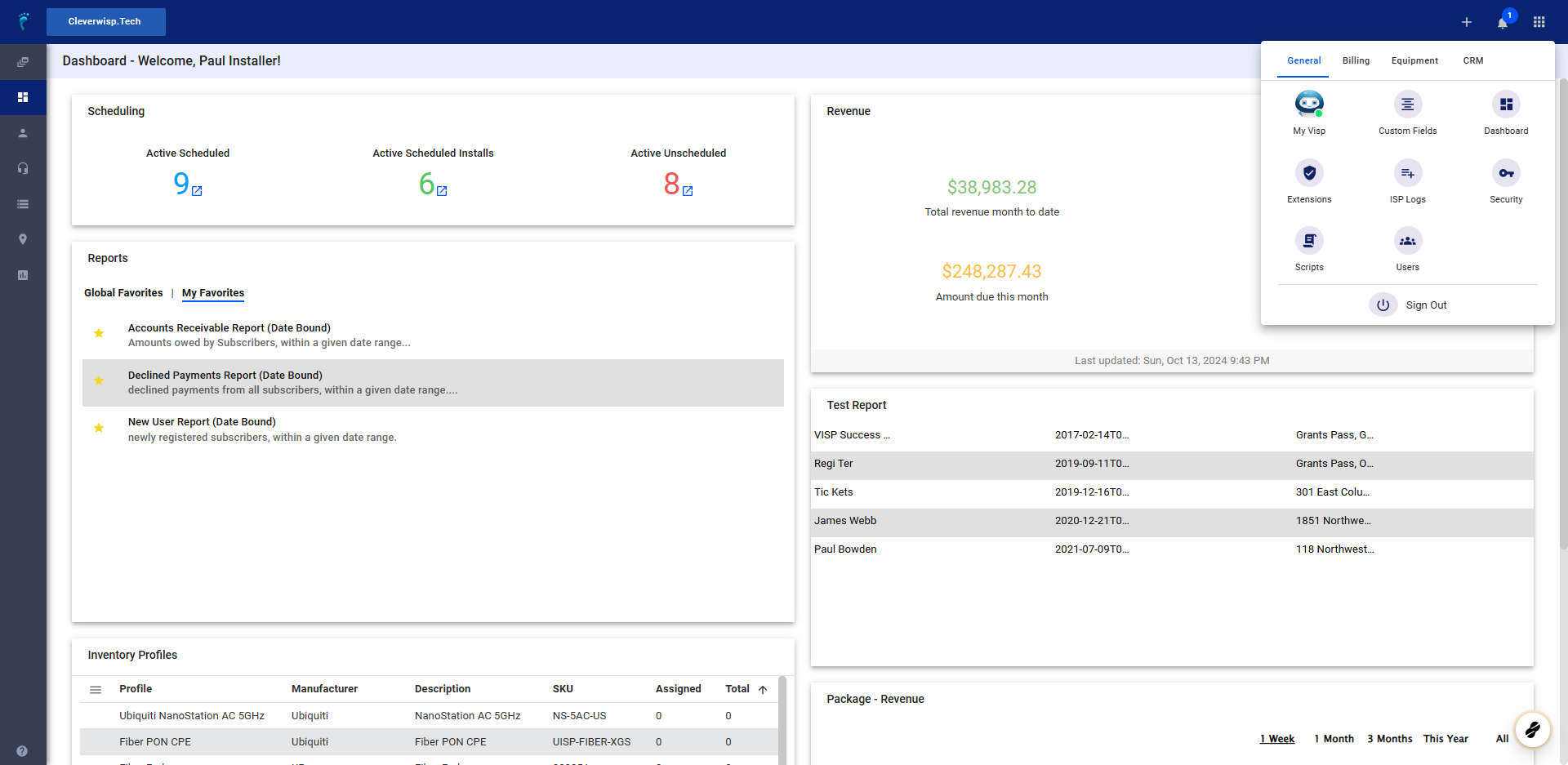

1. Locate the main menu (a nine-dot icon in the upper-right corner of the app).

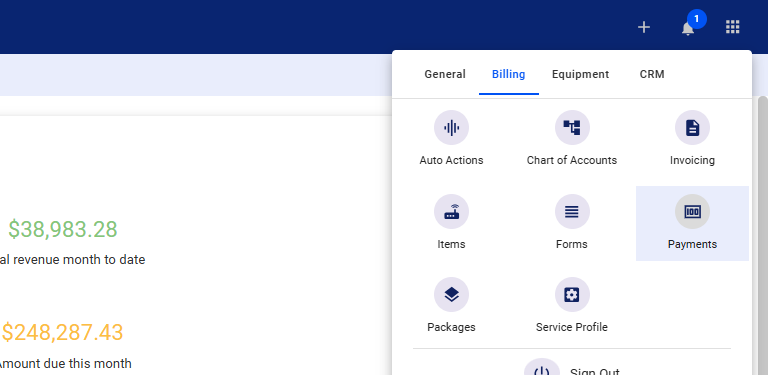

2. Access Payment Gateways

- Navigate to the “Billing” tab.

- Select “Payments.”

- Click on the “Payment Gateways” tab.

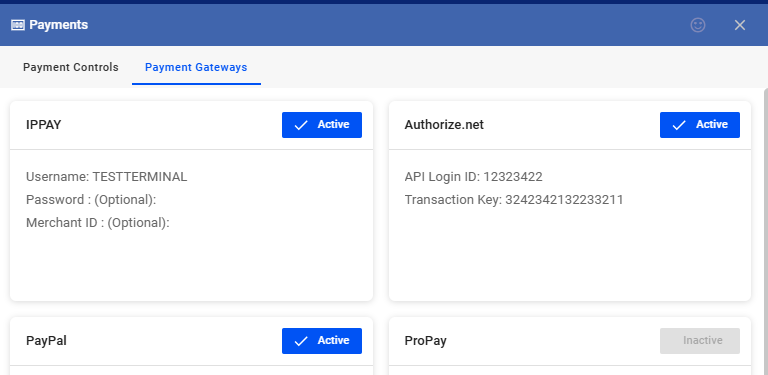

3. Select Your Processor

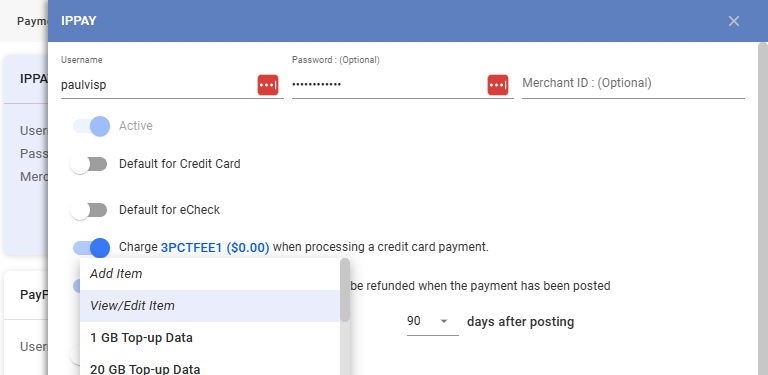

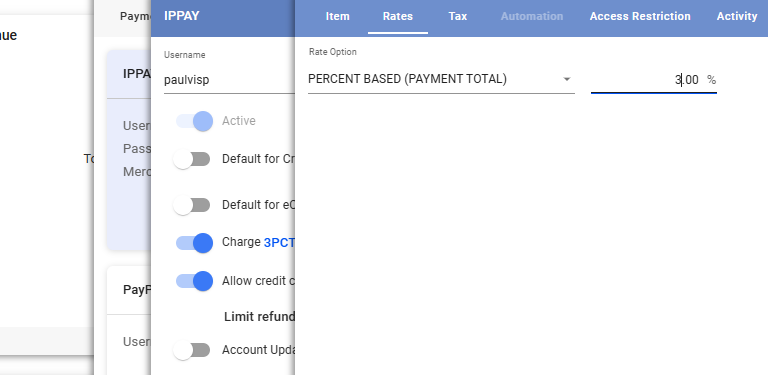

Choose your specific payment processor from the list (e.g., IPpay)

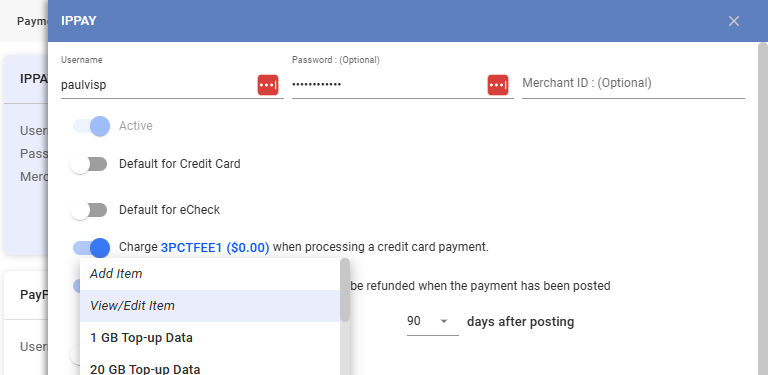

4. Configure Credit Card Fee

- Look for a section titled “Charge _____ when processing a credit card payment” or similar.

- Enable the option.

- Click on the blue highlighted text.

5. Select/Create Fee Item

- If you have existing fee items, choose the appropriate one from the list.

- If you need to create a new fee item, click “Add Item.”

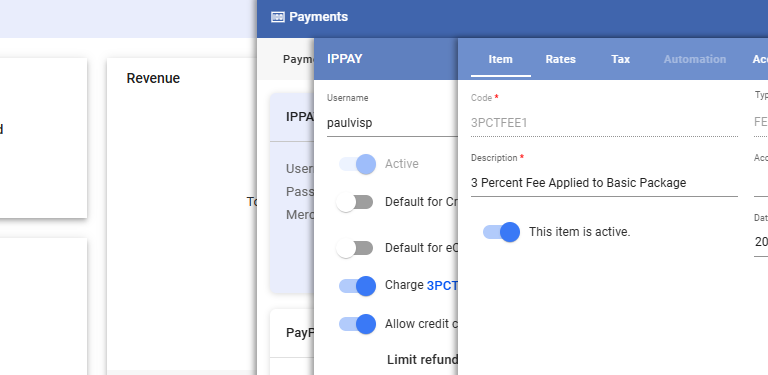

- Adding a New Item:

- Provide a descriptive name for the fee (e.g., “Credit Card Processing Fee”).

- Set the amount or percentage.

- Specify any applicable taxes.

- Editing an Existing Item:

- Select “View and Edit Item.”

- Adjust the rate, tax, or other details as needed.

6. Alternative Method (via Items Tab)

- From the main menu, go to “Billing.”

- Select “Items.”

- Under the “Fees” section, add or edit the specific charge for credit card processing.

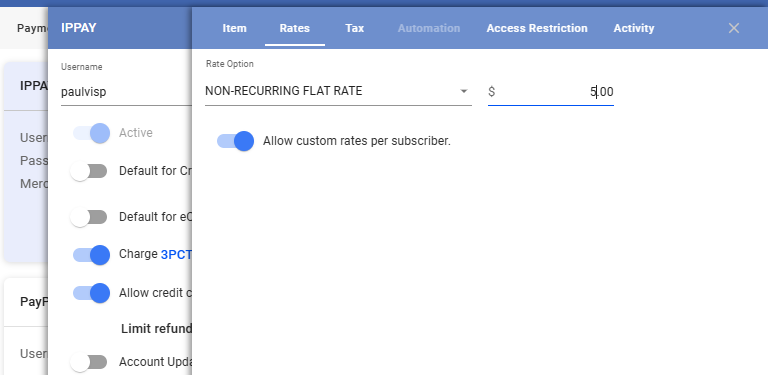

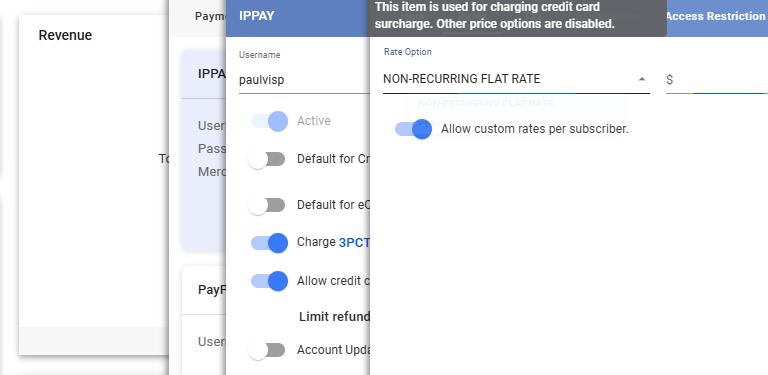

7. Set the Rate

In the Rate Option dropdown, select whether you want to charge a fixed amount or a percentage of the transaction.

8. Select NON-RECURRING FLAT RATE

- This is a fixed amount charged per transaction, regardless of the transaction value. For example, you might charge $0.30 per transaction.

- Pros:

- Simple to understand: Easy for both you and your customers to calculate.

- Predictable: You know exactly how much you’ll earn on each transaction.

- Cons:

- It is less fair for varying transaction sizes: A $0.30 fee is more significant on a $5 transaction than a $100 transaction.

- May discourage smaller purchases: Customers might hesitate to make small purchases if the flat fee seems disproportionately high.

9. Select PERCENT BASED (PAYMENT TOTAL)

- This is a percentage of the transaction amount. For example, you might charge 2.9% of each transaction.

- Pros:

- Scales with transaction size: The fee is proportional to the purchase amount, making it fairer for both you and your customer.

- Better for higher-value transactions: You generate more revenue on larger purchases.

- Cons:

- Less predictable: Your earnings will vary depending on the transaction amount.

- May seem complex to some customers: Calculating percentages can be slightly less intuitive for some people.

10. Save Changes.

Ensure you save all changes made to payment gateway settings and fee items.

💡 For more information about this and all other features in Visp, reach out to your Visp Client Success Team today.

Phone: 541-955-6900Email: success@visp.net

Open a ticket via www.visp.net/ticket