Late fees and re-billing fees are charges that may be added to your subscribers when they have been past due for a specified number of days. They encourage your subscribers to pay on time to avoid paying late or re-billing fees.

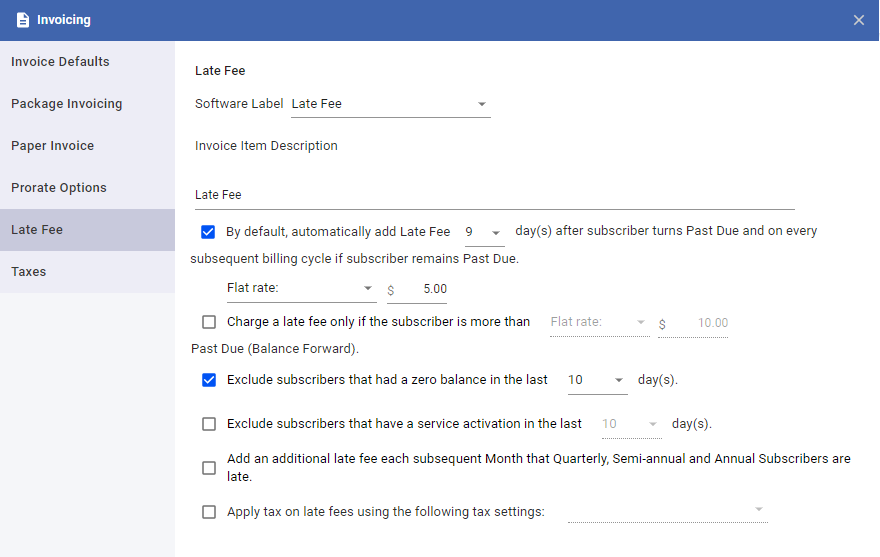

Go to Main Menu > Billings Tab > Invoicing > Late Fee Tab

- Choose the term you prefer – Late Fee and Re-billing Fee by simply selecting which label you want to have in the Software Label drop-down.

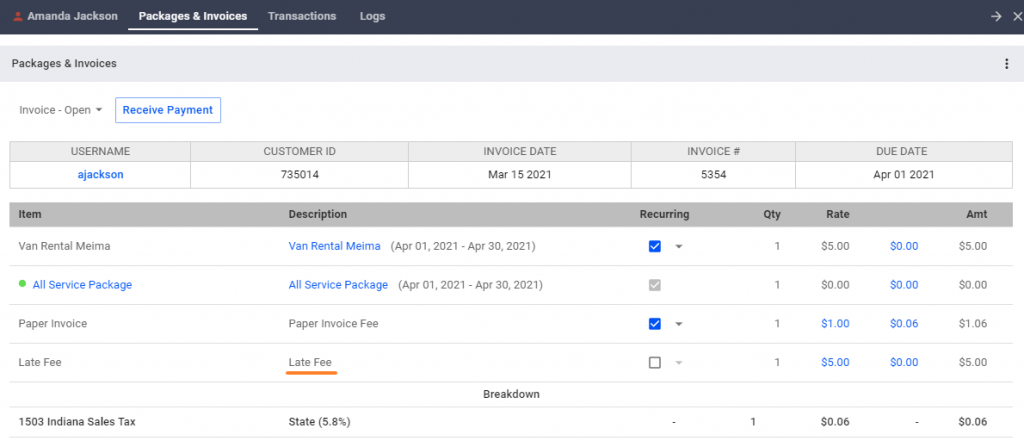

- When the late fee charge is added to the invoice, the late fee invoice item will follow the Software Label selected and the text in the Invoice Item Description.

- You can choose to “automatically add Late Fee” by default after a certain number of days that the subscriber has turned Past Due.

- You can also set how much the late fee would be. It can be a flat rate or a percentage of the Balance Forward with a minimum charge that you can also set.

Additional Conditions and their explanations:

- Charge a late fee only if the subscriber is more than Flat rate Past Due

- If checked, a late fee will be added only when a past due subscriber has a balance that’s more than the amount specified.

- Exclude subscribers that had zero balance in the last certain number of days

- If checked, the system excludes a past due subscriber from being charged with a late fee when he has a zero balance within the specified number of days.

- Exclude subscribers that have a setup date in the last certain number of days

- If checked, excludes a past due subscriber from being charged with a late fee when his or her setup date is within the specified number of days.

- Add an additional late fee each subsequent month that Quarterly and Annual subscribers are late.

- If checked, the rebilling fee will be added to Quarterly and Annual subscribers for each month they are Past Due.

- NOTE: This is only for Past Due Quarterly and Annual Subscribers.

- If the Subscriber Status Past Due option is at the end of the term, a late fee invoice will always be generated at the end of the month.

- If the Subscriber Status Past Due option is one day after the invoice due date, late fee invoices will be generated on the N days (from late fee condition) after the Invoice Due Day + 1 of every month.

- Example: If Invoice Due Date is on Sept. 20, then a subscriber turns past due on the 21st. IF “By default days” is 0 days, then late fee invoice will always be generated on the 21st of each month. However, if an invoice for packages is generated on that month, late fee will be generated with the invoice for packages.

- Apply tax on late fees using the tax setting

- If checked, the system will apply the selected tax to the late fee charge in the invoice.

- If the Subscriber tax setting is selected, it means that the tax applied to the late fee would be the same with the current tax setting the subscriber has.